2025 So Far: Inside India’s Healthcare Race for Scale, Stake & Strategy

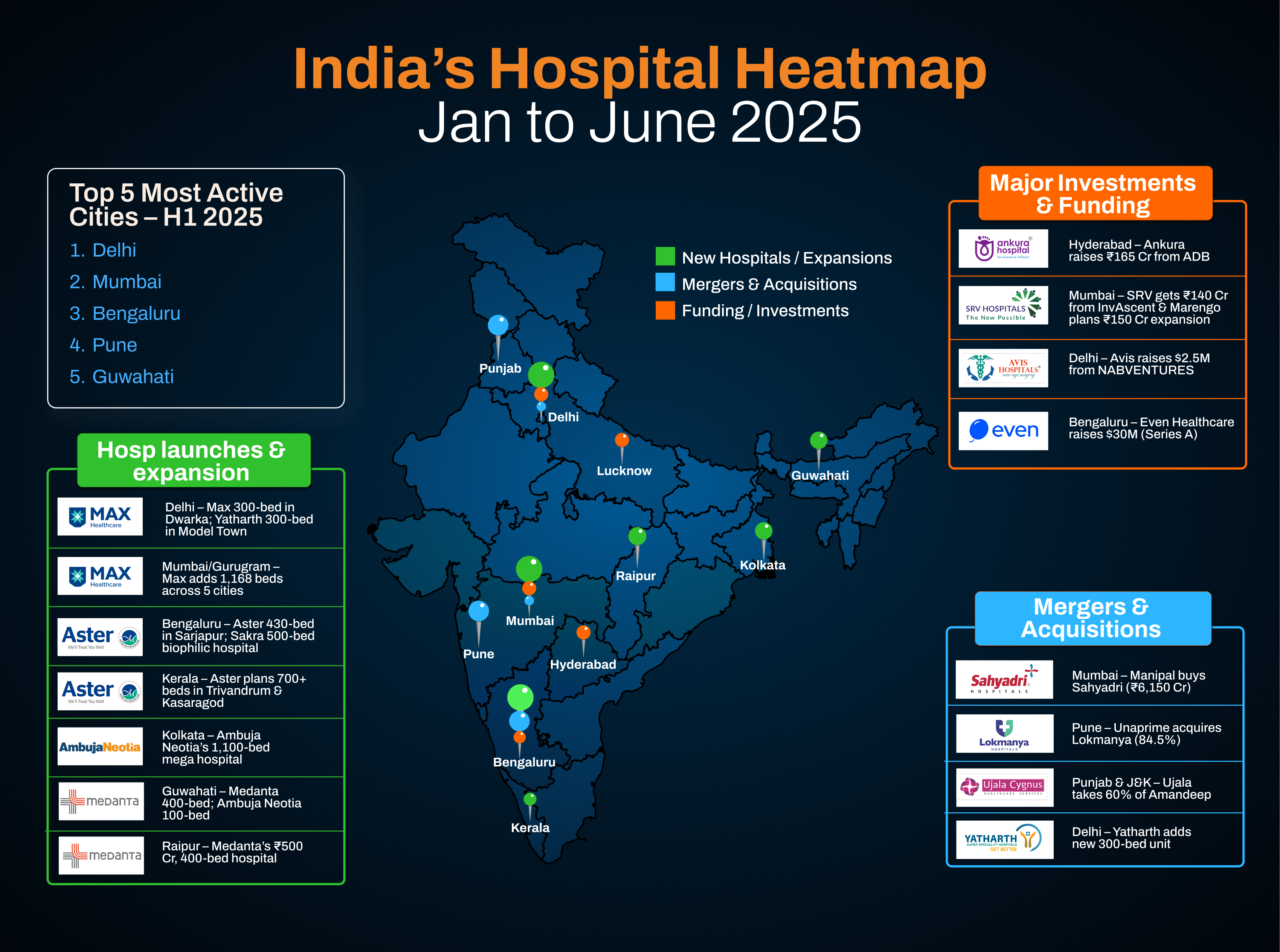

India’s hospital sector hasn’t waited for the year to mature, it’s already on the move. The first half of 2025 has been packed with big-ticket buyouts, new entrants betting on Tier 2 cities, and legacy players scaling their footprints across states.

With old players streamlining, new entrants eyeing untapped turf, and governments stepping in to fill critical care gaps, one thing is clear: healthcare isn’t just a service anymore. It’s becoming India’s most aggressive investment arena.

So what’s really happening behind the scenes? Let’s unpack the bold bets, fresh faces, and game-changing blueprints that are quietly redrawing the map.

Big Bets, Bigger Buys

2025 kicked off with a wave of consolidation in India’s hospital sector.

First up: Ujala Cygnus, backed by General Atlantic, moved to acquire a 60% stake in Amandeep Hospitals, marking its entry into Punjab and Jammu & Kashmir. The deal will push its network from 21 to 26 hospitals, raising its bed capacity to nearly 2,800. Around the same time, the group appointed Nitin Nag as its new Managing Director and CEO, a leadership refresh aligned with its push across North India’s underserved regions.

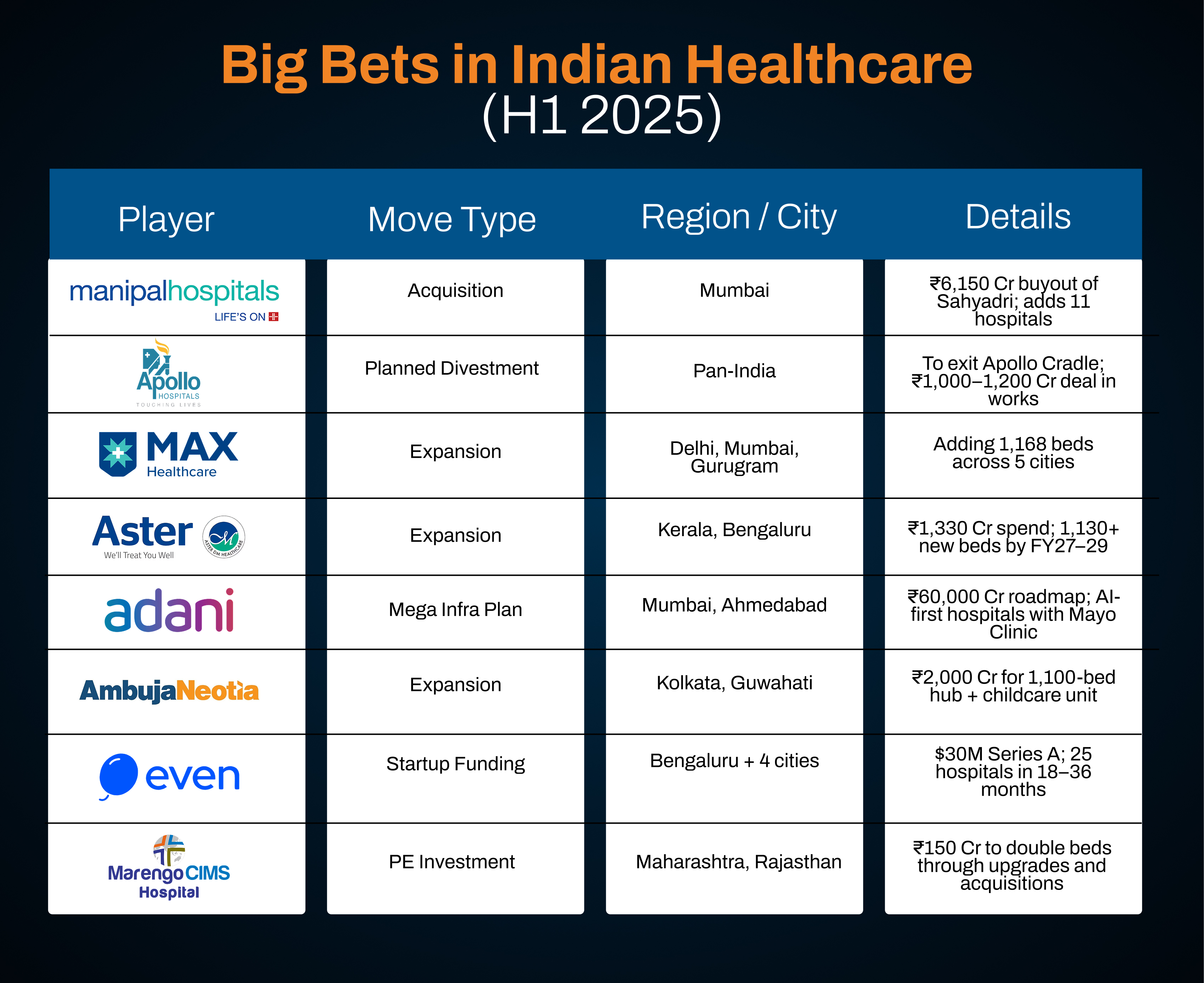

Then came the Maharashtra headline grabber. A fierce bidding war broke out for Sahyadri Hospitals, with Manipal Hospitals, IHH Healthcare, EQT, and KKR submitting offers in the INR 5,000 Cr range. Backed by Temasek, Manipal Hospitals, led by Dr Ranjan Pai, emerged as the frontrunner. Fuelled by a $600 million credit line from KKR (its biggest India credit deal yet), Manipal acquired Sahyadri for INR 6,150 Cr, adding 11 hospitals and boosting its capacity to 12,000 beds.

The deal pushed Manipal’s valuation to $13 billion, up from $3 billion in 2021, and set the stage for a $1 billion IPO eyed for 2026.

Meanwhile, Unaprime Healthcare LLP took a decisive step by acquiring an 84.5% stake in Lokmanya Hospitals, a Pune-based chain known for robotic surgery. With plans to grow from 300 to 800 beds and build centers of excellence in orthopedics, cardiac sciences, and oncology, Lokmanya is now on track to become one of Maharashtra’s fastest-growing multi-specialty hospital chains.

Capital Rush: Who’s Investing Where in 2025

In a wave of transformative moves, India’s hospital sector is witnessing unprecedented capital infusion and infrastructure growth from super-specialty chains to startup disruptors and public hospitals.

It began with Ankura Hospitals, a Hyderabad-based chain focused on women and child care, securing ₹165 crore from the Asian Development Bank (ADB). The funds will power Ankura’s pan-India expansion, boosting pediatric, maternity, and gynecology services with new state-of-the-art facilities.

Soon after, SRV Hospitals, known for its critical care-led model, raised ₹140 crore from InvAscent, a life sciences-focused PE fund. The investment will fuel SRV’s tertiary care network across Mumbai, Nashik, and Bengaluru, and strengthen its advanced surgical and consultant-led care capabilities.

In the public sector, Tripura Chief Minister Manik Saha announced a ₹100 crore allocation for a new eye hospital in Agartala, a major step to improve access to ophthalmic care in the Northeast.

Big Chains, Bigger Ambitions

Established players are now eyeing new frontiers. Medanta, led by Dr. Naresh Trehan, announced two parallel expansions, a ₹500 crore, 400-bed hospital in Guwahati, and a second ₹500 crore multi-specialty hub in Raipur, targeting over 50 million people across central and northeast India.

Max Healthcare isn’t far behind. The chain unveiled a 300-bed greenfield super-specialty hospital in Dwarka, Delhi, packed with 120+ ICU beds, modular OTs, and Cath Labs, and became one of the first in NCR to get a 5-star GRIHA sustainability rating. Max is expanding nationwide into Thane, Mumbai, Mohali, Delhi, and Gurugram, with 1,168 new beds and a goal to cross 2,000 beds in 3–4 years.

The South & East Get Their Due

Aster DM Healthcare is doubling down on Kerala and Karnataka. With an ₹850 crore commitment across Trivandrum (454 beds) and Kasaragod (264 beds), and a ₹480 crore investment into a 430-bed hospital in Sarjapur, Bengaluru, Aster is on track to reach 3,453 beds in Kerala and 2,000+ in Bengaluru by FY27–FY29.

Meanwhile, Ambuja Neotia Healthcare is shaking up the East. Known for its luxury hotels, the group is now committing ₹2,000 crore to healthcare infrastructure in Kolkata and Guwahati, including a 1,100-bed mega-hospital and a 100-bed women's and childcare centre in Guwahati, inaugurated by Assam CM Himanta Biswa Sarma. With ambitions extending to Nepal, Bhutan, and Bangladesh, the group is building a transnational presence from Bengal to the Himalayas.

Startups & Specialists Are Stepping Up

Disruptors are making their mark too. Even Healthcare, a Bengaluru-based managed care startup, launched its first 70-bed hospital on Race Course Road after raising $30 million in Series A. Its model blends insurance, diagnostics, and hospitalization under one membership, and plans are underway to open 25 hospitals in 18–36 months across Mumbai, Delhi, Hyderabad, and Pune.

In North Bengaluru, Sakra World Hospital, backed by Secom Medical System and Toyota Tsusho, is building a ₹1,000 crore, 500-bed biophilic hospital designed by Tandem Healthcare, with nature-inspired spaces and programs in cancer care, interventional neuro, and mother & child services.

In Bihar, ASG Eye Hospital joined hands with the State Health Society to launch 200 tech-enabled Vision Centers across 38 districts, offering telemedicine-powered primary eye care to 40 lakh+ patients annually.

Other niche expansions include:

- Avis Hospital, focused on varicose vein care, raised $2.5 million from NABVENTURES to scale across 15+ Tier 2 and 3 cities.

- Yatharth Hospitals launched a 300-bed super-specialty hospital in Model Town, Delhi, bringing its total network to 7 hospitals and 2,300+ beds.

- Marengo Asia Healthcare, backed by Samara Capital and Havells, announced a ₹150 crore expansion into Maharashtra and Rajasthan, aiming to double its capacity from 1,500 to 3,000 beds through acquisitions and upgrades.

As India’s healthcare sector surges ahead, three standout developments are quietly redefining how care will be delivered, funded, and scaled, from corporate recalibrations to billion-rupee visions and public-sector revival.

First, Apollo Hospitals is reportedly preparing to divest its premium maternity and pediatric division, Apollo Cradle and Children’s Hospital Ltd (ACCHL), in a deal estimated at ₹1,000–1,200 crore. With 13 hospitals and 363 beds across major metros, ACCHL has carved a niche in urban, high-end maternal care. But Apollo seems ready to pivot. The move signals a sharper focus on high-margin verticals like oncology, transplants, and quaternary care, areas where Apollo sees bigger growth, scale, and returns.

Meanwhile, in a headline-making move, the Adani Group unveiled a ₹60,000 crore healthcare roadmap, beginning with AI-first, 1,000-bed hospitals in Mumbai and Ahmedabad. Built in partnership with Mayo Clinic, these “Adani Healthcare Temples” will blend clinical care, academic training, and research under one roof. The conglomerate also spotlighted India’s under-addressed spinal epidemic, proposing mobile rural operating theatres and next-gen surgical innovations to bridge rural-urban care gaps.

On the public health front, Delhi’s government announced a ₹860 crore boost to revive stalled infrastructure and add 1,300+ hospital beds across five existing facilities. The plan also includes 11 new hospitals, seven of which will have dedicated ICU capacity, a much-needed reinforcement after recent seasonal disease spikes and pandemic-era overloads. With parallel upgrades in roads and civic amenities, the capital is betting on a more integrated model of urban health access.

Closing: And That Was Just the First Half

So that’s the story so far includes mergers, expansions, billion-rupee bets, and big vision moves. The first six months of 2025 have made one thing clear: healthcare is India’s biggest play right now. From private giants to public pushes, everyone’s in, and the game is only getting bigger.

What will the second half bring? More deals? Bigger disruptions? We’ll have to wait and see.

Stay tuned to Digital Health News as we’ll keep tracking every move, and bring you the stories that matter.

𝗗𝗶𝘀𝗰𝗹𝗮𝗶𝗺𝗲𝗿: This report is based on publicly available information as of the first half of 2025. All developments are subject to change based on future regulatory, financial, or operational updates. None of the mentions are intended as promotional or investment advice.