From Back Office to Brain Center: India’s GCCs Power Global Healthcare Innovation

In 2025, India is no longer the back office of global healthcare. It has become the operating system.

With more than fifty dedicated healthcare and life sciences Global Capability Centers (GCCs) running close to a hundred campuses, India now powers everything from drug discovery to digital health engineering.

These centers employ several hundred thousand professionals, making them not only delivery hubs but critical decision-making engines for global pharmaceutical companies, medtech majors, health systems, and digital health innovators.

The sheer scale is undeniable, and the inevitability is clear: global healthcare’s pipelines of research, product development, and regulatory operations increasingly run through India.

Across these GCCs, the focus has moved decisively away from transactional work and back-office processing to high-value, outcome-driven contributions. Today, India’s GCCs handle complex drug-discovery analytics, clinical-trial operations, regulatory science, product engineering, and even full-stack digital health product development. In doing so, they have transformed from peripheral cost centers into integral nodes of global healthcare strategy.

For multinational healthcare and life sciences organizations, the objective behind these investments is straightforward: reduce cycle times, scale technical talent quickly, cut costs without compromising quality, and, most importantly, generate measurable business outcomes. Faster time-to-market for molecules, improved clinical-trial efficiency, stronger pharmacovigilance, reduced total cost of ownership for platforms, and better patient experiences are now the explicit expectations from these centers.

The Evolution of Healthcare GCCs: From Claims Factories to Value Enablers

The journey of healthcare and life sciences GCCs in India has unfolded in four broad phases, each marked by a distinct shift in scope and ambition.

In the 1990s, what can be described as GCC 1.0, India became the world’s claims factory. Multinationals leveraged the country’s low-cost, English-speaking workforce to process insurance claims, handle medical transcriptions, manage billing, and prepare regulatory documents at scale. It was the era of cost arbitrage, where efficiency and standardisation were the only goals, and companies could dramatically cut expenses by relocating routine work to India.

The early 2000s gave rise to GCC 2.0, defined by shared services but limited integration. These centers operated like extended BPO partners, tackling discrete functions but rarely influencing larger corporate strategies. They consolidated workflows such as customer service, IT support, or isolated R&D functions, but did so without building cohesive capabilities across the value chain. Bayer’s Shared Service Center, set up in 2005, epitomises this phase; efficient but compartmentalized.

By the late 2000s, GCC 3.0 marked a more profound shift. India began hosting multi-capability hubs that took end-to-end ownership of core business functions, including drug development, clinical trials, and platform engineering. Johnson & Johnson’s pharmaceutical development and research facilities in Mumbai, AstraZeneca’s Global Technology Center launched in Chennai in 2014, and Medtronic’s Global IT Center in Bengaluru in 2015 are all examples of global firms consolidating not just cost advantage but also innovation-driven mandates in India.

The current phase, GCC 4.0, represents the most transformative leap. Today’s Indian GCCs act as value-enablement partners, not just delivery units. They integrate business, technology, and corporate functions into unified capability platforms. They manage regulatory science, clinical innovation, advanced analytics, and digital health product portfolios. They sit at the intersection of R&D, IT, and business operations, making them indispensable to global healthcare delivery and innovation. India is no longer filling gaps; it is setting the pace.

Why India: Scale, Skills, and the Policy Push

The magnetism of India as the hub for healthcare and life sciences GCCs rests on three intertwined strengths: scale, capability, and supportive policy.

Every year, India produces more than 2.5 million STEM graduates; more than the entire population of Finland. Add to this the millions of experienced IT professionals who are adept at cloud computing, data science, and engineering for regulated industries, and it becomes clear why multinationals anchor their AI, analytics, and pharmaceutical development pipelines here.

Beyond talent, India offers an ecosystem that nurtures innovation. Startups, research institutions, and engineering schools are tightly interwoven, creating fertile ground for companies to assemble multidisciplinary teams. States such as Karnataka and Telangana have gone further by building dedicated clusters, software parks, and incentive schemes tailored for life sciences and medtech.

Hyderabad, for instance, has benefited from focused pharma clusters and strong government support, quickly rising to become a preferred destination alongside Bengaluru.

Equally important is the regulatory reassurance India has begun to offer global players. The Digital Personal Data Protection Act (2023) provides a structured framework for handling sensitive healthcare data, while the Ayushman Bharat Digital Mission (ABDM) is laying the foundations for interoperable health records and digital health infrastructure.

Together, they signal to global pharma and medtech firms that India is not only a talent powerhouse but also a jurisdiction committed to compliance, privacy, and patient safety.

The Technology Stack Driving Change

The work carried out inside India’s GCCs today is powered by a cutting-edge technology stack. Artificial intelligence, cloud computing, cybersecurity, and data engineering are no longer optional tools; they are the backbone of delivery. Importantly, these technologies are not just being tested; they are in production.

At AstraZeneca’s Chennai and Bengaluru centers, AI-driven models are being used to triage molecules even before wet lab work begins, reducing wasted time and cost in early discovery. Evernorth, Cigna’s health services arm, has deployed generative AI in Hyderabad to optimise trial design, moving away from pilot experiments to full-fledged operational workflows. Optum is building cloud-based data lakes in its upcoming 500,000 sq ft Chennai campus, which will serve as the backbone for payer analytics and care management platforms. Sanofi’s Hyderabad site is using AI-driven pharmacovigilance to process and interpret global safety reports in real time.

The cybersecurity dimension is equally critical. GCCs today invest heavily in HIPAA-grade frameworks, GDPR-compliant data segregation, and continuous monitoring systems to protect sensitive health data.

Advanced DevOps and regulated software development practices enable validated code and documentation to be shipped directly to regulators in the US and EU. These choices are no longer supplementary; they define the credibility of India’s role in the global network.

From Molecule to Market: Collapsing the Distance

The Market Map: Scale, Momentum, and New Bets

The last eighteen months have marked the largest wave of healthcare and life sciences GCC investments in India’s history. Optum Global Solutions, the services arm of UnitedHealth Group, signed a 500,000 sq ft lease in Chennai to build a new delivery and engineering campus that will seat more than 8,000 professionals.

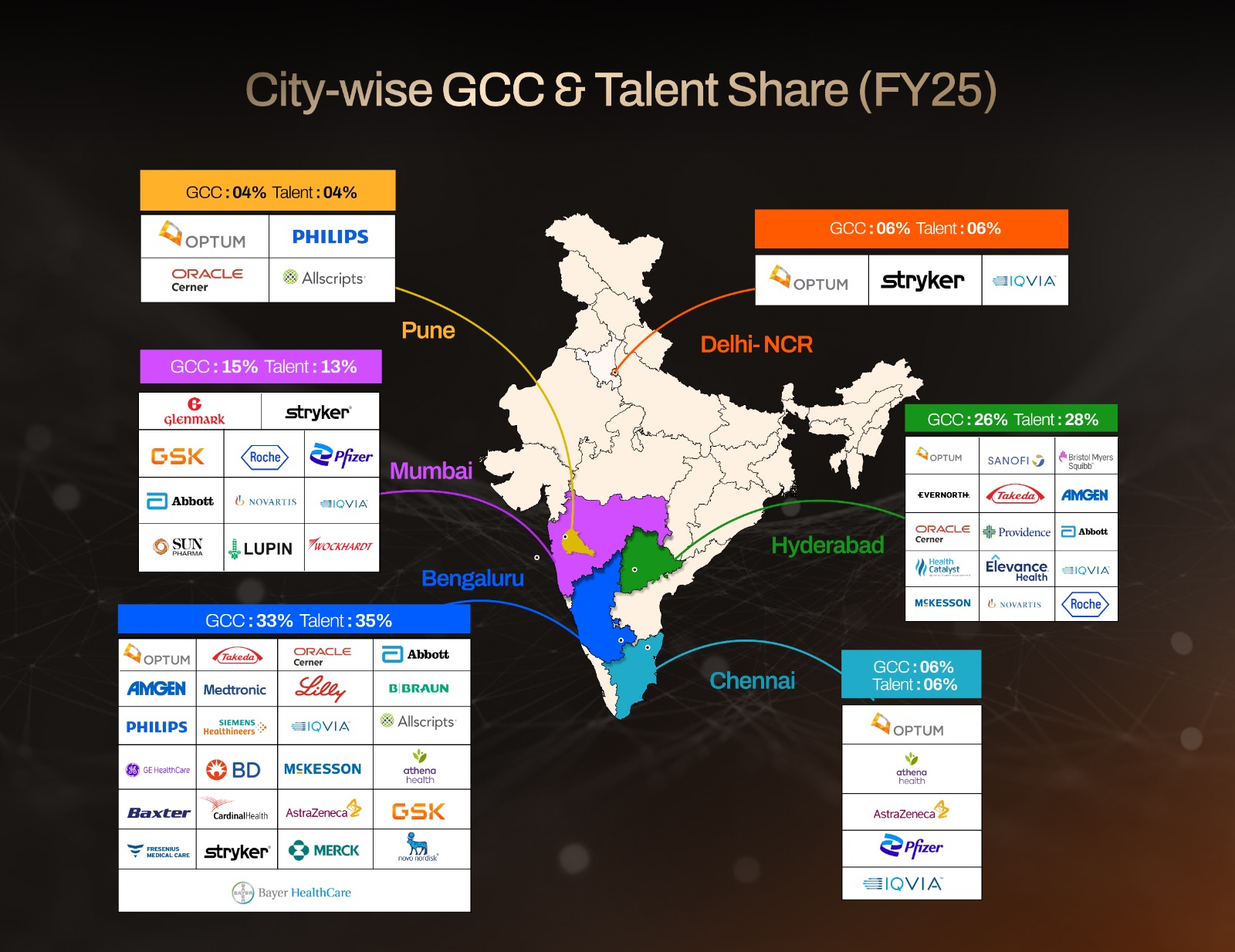

This comes on top of its already expansive footprint in Noida, Gurugram, Bengaluru, Hyderabad, and Pune, reflecting how US payer and provider groups now see India as a core part of their operating system.

Hyderabad has rapidly emerged as a magnet for global pharmaceutical and biotech investments. Sanofi has committed to a multi-year expansion, while Bristol Myers Squibb established a central innovation hub in the city in 2024 with a focus on clinical analytics and digital health.

Evernorth, the health-services arm of Cigna, also chose Hyderabad for its flagship innovation hub, where it is scaling generative AI and data-driven healthcare engineering.

Other global pharma players, including Takeda and Amgen, have set up dedicated centers in Hyderabad and Bengaluru, further deepening the city’s role as a high-value life sciences cluster.

Bengaluru continues to anchor the medtech and healthcare IT segment. GE Healthcare runs major engineering and imaging software operations from the city, while Philips drives product development and digital services out of its Bengaluru and Pune sites.

Medtronic, Siemens Healthineers, and Becton Dickinson have all expanded engineering and R&D capacity in Bengaluru, alongside Cardinal Health, Baxter, Fresenius Medical Care, and B. Braun, which have created strong capability hubs in southern India. Stryker, meanwhile, splits its operations between Bengaluru, Gurugram, and Mumbai, reflecting a pan-India medtech strategy.

Mumbai and Ahmedabad also remain active GCC locations for pharma. Glenmark Pharmaceuticals, Sun Pharma, Lupin, and Wockhardt continue to strengthen their digital and regulatory operations out of Mumbai.

Zydus Lifesciences anchors its GCC presence in Ahmedabad, while Abbott operates across Mumbai, Bengaluru, and Hyderabad. Together, these hubs reflect how traditional pharma majors are pairing discovery and manufacturing in the West with large-scale regulatory, data, and innovation functions in India.

The overall momentum is unmistakable. From Optum’s record-setting Chennai lease to Sanofi’s Hyderabad expansion, to the steady growth of Indian-led biopharma companies such as Biocon, the pattern is consistent: India is no longer a support base. It is a global command center for healthcare innovation, R&D, and delivery.

Company Spotlights: What Each Center Does and Where It Sits

The diversity of players now operating in India demonstrates the breadth of capabilities being built. Optum (UnitedHealth Group) runs some of the largest healthcare GCC operations in the country, spanning Noida, Gurugram, Bengaluru, Hyderabad, Pune, and soon Chennai. Its India teams manage everything from analytics and payer services to clinical platforms and large-scale engineering.

Providence’s innovation and operations center in Hyderabad, established in 2020, supports healthcare technology, cybersecurity, finance, and client services, with plans to more than double its workforce.

Oracle Health, along with its acquired Cerner business, operates out of Bengaluru, Hyderabad, and Pune, delivering hospital information systems, cloud-based health platforms, and regulatory solutions.

Athenahealth has created GCCs in Chennai and Bengaluru that focus on practice management software and EHR innovation, while Allscripts runs healthcare IT delivery hubs from Pune and Bengaluru. Health Catalyst has chosen Hyderabad for its India presence, supporting analytics-driven healthcare transformation, while Carelon Global Solutions (Elevance Health) operates across multiple cities, including Hyderabad, as a major engineering and digital health capability center.

On the clinical research and data side, IQVIA maintains hubs across Bengaluru, Hyderabad, Gurugram, Mumbai, and Chennai, managing global trials, data analytics, and regulatory submissions. McKesson has established a growing presence in Bengaluru and Hyderabad, contributing to supply chain analytics and healthcare operations.

Meanwhile, pharma majors such as Novartis (Hyderabad, Mumbai), AstraZeneca (Chennai, Bengaluru), Eli Lilly (Bengaluru), Bayer (Bengaluru), Pfizer (Chennai, Mumbai, Visakhapatnam), Roche (Hyderabad, Mumbai), Merck (Bengaluru), GSK (Bengaluru, Hyderabad, Mumbai), Novo Nordisk (Bengaluru), and Amgen (Bengaluru) have all integrated their India GCCs directly into global R&D and regulatory workflows.

Medtech anchors remain strong. GE Healthcare, Philips, Medtronic, Siemens Healthineers, Stryker, Becton Dickinson, Cardinal Health, Baxter, Fresenius Medical Care, and B. Braun all operate engineering, software, and regulatory centers in Bengaluru, Pune, Gurugram, Mumbai, and Delhi. These facilities not only support global product portfolios but also increasingly build digital health platforms designed for international markets.

What unites this diverse market map is a single fact: whether it is payer services in Noida, pharmacovigilance in Hyderabad, clinical analytics in Bengaluru, or medtech engineering in Pune, India now hosts the full spectrum of healthcare GCC capabilities.

The country has become the place where back-office, R&D, product, and digital engineering converge into one operating system.

Challenges: The Battle for Leadership

Yet, the opportunity comes with constraints that will determine which GCCs lead and which lag.

The first challenge is data governance. Healthcare data is among the most sensitive categories of personal information, and GCCs must comply with HIPAA, GDPR, and a growing array of regional regulations. This requires investments not just in secure cloud and encryption but in formalised governance frameworks that reassure global headquarters and regulators alike.

The second challenge is talent. The war for talent in India is brutal. The same AI engineer who can optimise a molecule for Novartis can also build a payments engine for Stripe. Unless healthcare GCCs design distinct career paths that combine technical growth with domain depth, they risk losing their best minds to fintech, big tech, or startups offering flashier trajectories.

The third challenge is regulatory complexity. Life sciences R&D and medical devices are among the most tightly regulated sectors in the world. Global harmonisation efforts, local approval requirements, and post-market obligations demand deep domain expertise. GCCs that treat healthcare as just another vertical will struggle. The leaders will be those who marry regulatory fluency with cloud and AI expertise, creating teams that can scale globally without stumbling on compliance.

Outlook: India as the Command Center of Global Healthcare

The next phase of India’s GCC journey is about scale and sophistication. By 2030, one in three global clinical trials could be managed from India. This is not speculation but a likely outcome given current investments, workforce growth, and the deepening trust of global healthcare majors. India is on course to surpass not just traditional outsourcing destinations like the Philippines or Eastern Europe, but to become the central command hub for healthcare delivery and innovation worldwide.

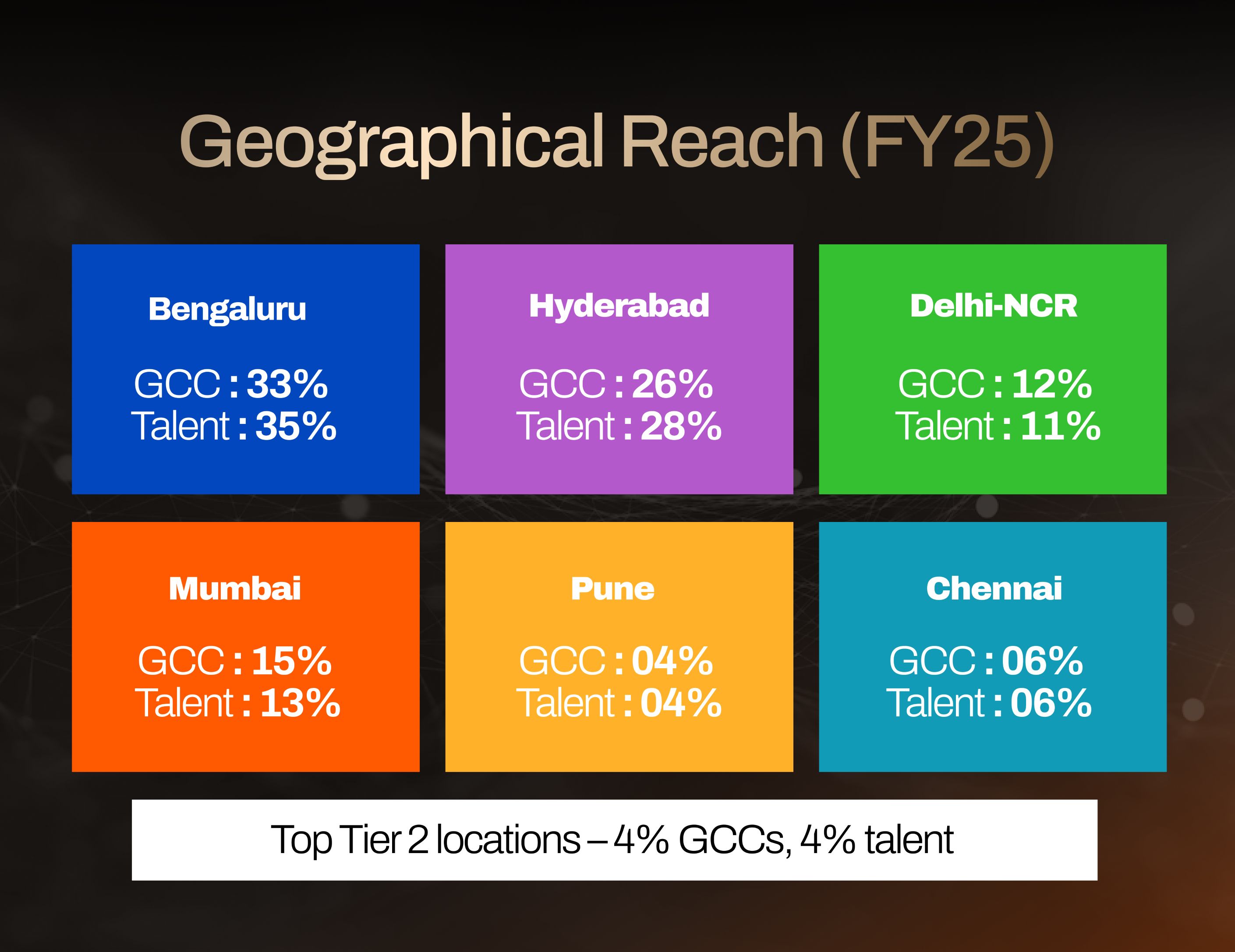

What makes this even more compelling is the geographic diversification now underway.

While Bengaluru and Hyderabad remain the twin giants, states like Odisha are positioning themselves as the “Tier-2 next wave.”

At TiECon Bhubaneswar 2025, the Chief Minister openly invited global investors to “invest, innovate, and grow with us,” unveiling a dedicated AI policy and digital infrastructure strategy to attract GCCs. Cities such as Cuttack, Rourkela, Sambalpur, and Berhampur are being pitched as the next frontier, showing how state governments are competing to capture their share of the healthcare GCC story.

Conclusion: From Cost Centers to Frontlines

India’s healthcare and life sciences GCCs are no longer cost-saving extensions of global corporations. They are the frontlines of global healthcare, driving discovery, engineering, trials, and safety operations that directly impact patients around the world. The true measure of success will not be headcount but outcomes: molecules discovered faster, trials accelerated, safety signals caught earlier, and patients reached with better products and services.

The silent revolution is over. India’s role is now loud, central, and irreversible. Global healthcare runs on the code, analytics, molecules, and platforms emerging every day from its GCCs. For companies and policymakers alike, the imperative is clear: double down on talent, compliance, and innovation, because the future of healthcare is being written in India.

Perhaps the most striking change is the degree to which India’s GCCs now participate across the entire drug development lifecycle, from discovery to market.

In discovery, Indian teams conduct bioinformatics, medicinal chemistry, and protein engineering. In fact, protein engineering teams in Hyderabad are already designing molecules that feed directly into Phase 1 pipelines in Boston and Basel, collapsing the traditional distance between discovery and decision.

In clinical trials, GCCs manage everything from patient recruitment analytics to data capture, centralized monitoring, safety reporting, and biostatistics. Industry analysts estimate that predictive chemistry models run in Bengaluru have cut early discovery cycles by up to nine months, saving as much as $50 million per molecule. Clinical monitoring teams in India track trial performance in real time, while safety reporting teams meet 24-hour global timelines for adverse event reporting. Medical writing and regulatory submissions are produced with efficiency and compliance, ready for review by the US FDA or the European Medicines Agency.

Post-market, Indian GCCs play a central role in pharmacovigilance and global safety monitoring. Around-the-clock surveillance platforms managed from Bengaluru and Hyderabad are capable of identifying and reporting safety signals across geographies, creating a continuous feedback loop that keeps patients safe while enabling global companies to scale monitoring without ballooning costs.