H1 2025 Funding Recap: How $828 Mn Reshaped Indian Healthtech

In a year when IPO buzz, shifting capital strategies, and geopolitical recalibrations have defined India’s startup landscape, one sector has quietly staged a renaissance: health tech.

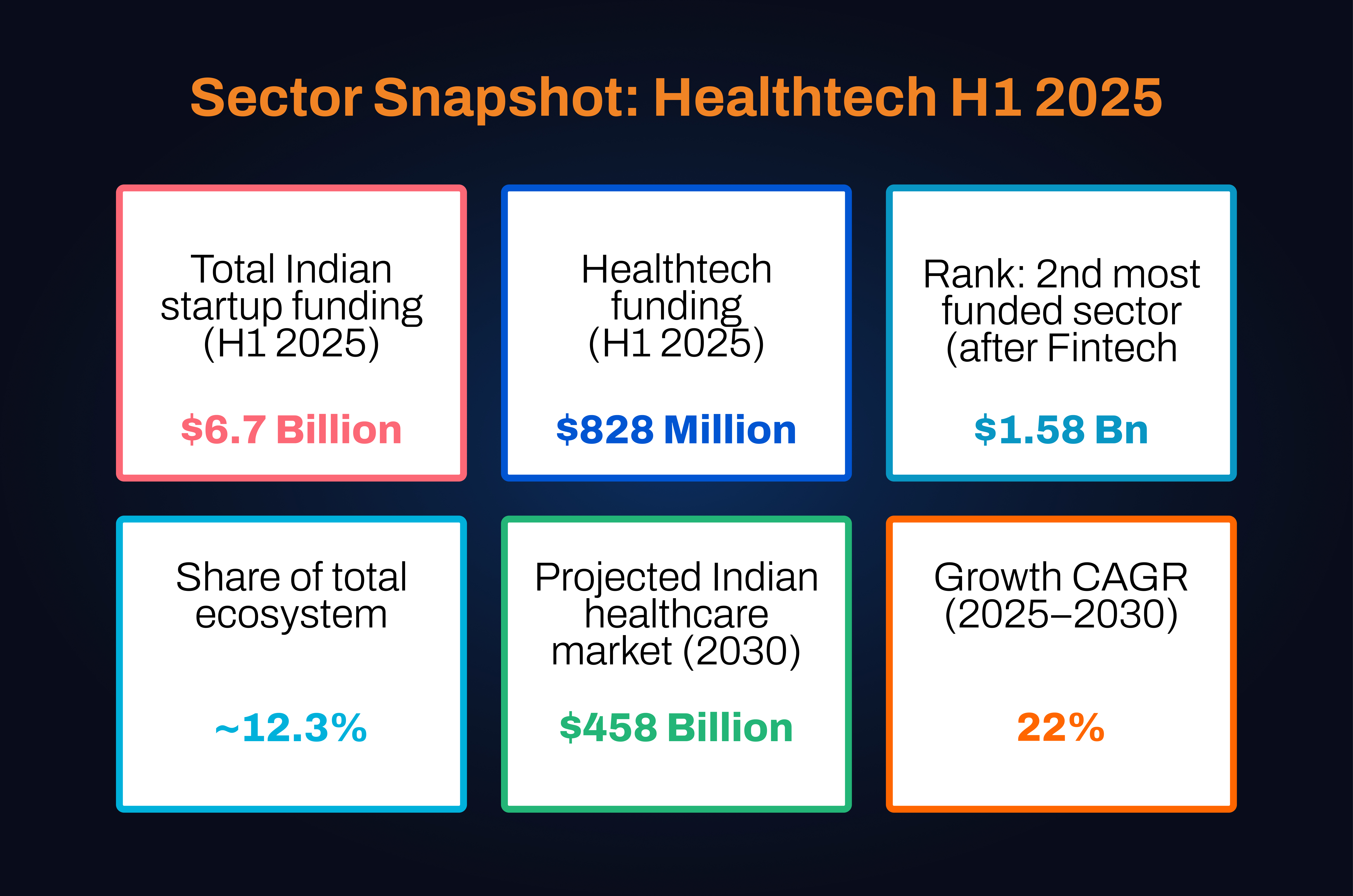

While Indian startups collectively raised $6.7 billion in the first half of 2025, health tech alone attracted $828 million, making it the second most funded vertical after fintech, ahead of traditionally dominant sectors like SaaS, e-commerce, and edtech.

But these aren’t just numbers; they reflect a sector that is not merely surviving the funding winter, but redefining its thesis. Healthtech in 2025 is no longer about urgent digital interventions or pandemic-induced spikes. It is a layered, infrastructure-first movement built on deep technology, clinical partnerships, and full-stack delivery models that address long-standing inefficiencies across India's complex healthcare value chain.

Today’s founders aren’t building quick-fix solutions. They are re-architecting how India delivers, funds, and personalizes care. Whether AI-powered neurodiagnostics, rural-first surgical pathways, mental health infrastructure, fertility tech, or precision oncology, this wave of startups is pushing toward sustainable, integrated, and measurable outcomes.

More importantly, these ventures are not operating in silos; they’re collaborating with payers, providers, and public systems in ways the ecosystem hasn’t seen before.

The timing couldn’t be more opportune.

India’s healthcare market is projected to grow from $100 billion to $458 billion by 2030, backed by a robust 22% CAGR.

A surge in chronic illnesses, digital health acceleration, value-based insurance models, and a rising middle class demanding better care have created fertile ground. Healthtech is no longer a pandemic anomaly; it’s a structural necessity.

And investors are taking note. The quality of capital in H1 2025 reflects growing conviction. Global funds, dedicated life sciences VCs, family offices, and early-stage accelerators are placing bigger, more thematic bets. What stands out is not just who is investing-but how. The funding rounds reveal a clear pattern: larger seed tickets, more profound domain expertise, and founders with clinical, research, or regulatory depth, not just tech résumés.

This report takes an in-depth, editorial lens to the month-by-month evolution of India’s health tech funding story in H1 2025, ending with a dedicated section for July, offering a glimpse into the current momentum. From the verticals attracting capital to the evolving investor playbooks and long-term implications, an unfiltered view follows into one of the most mission-critical, and now, market-validated, sectors of Indian innovation.

Sector Snapshot: Healthtech H1 2025

January: Deeptech Lays the Foundation

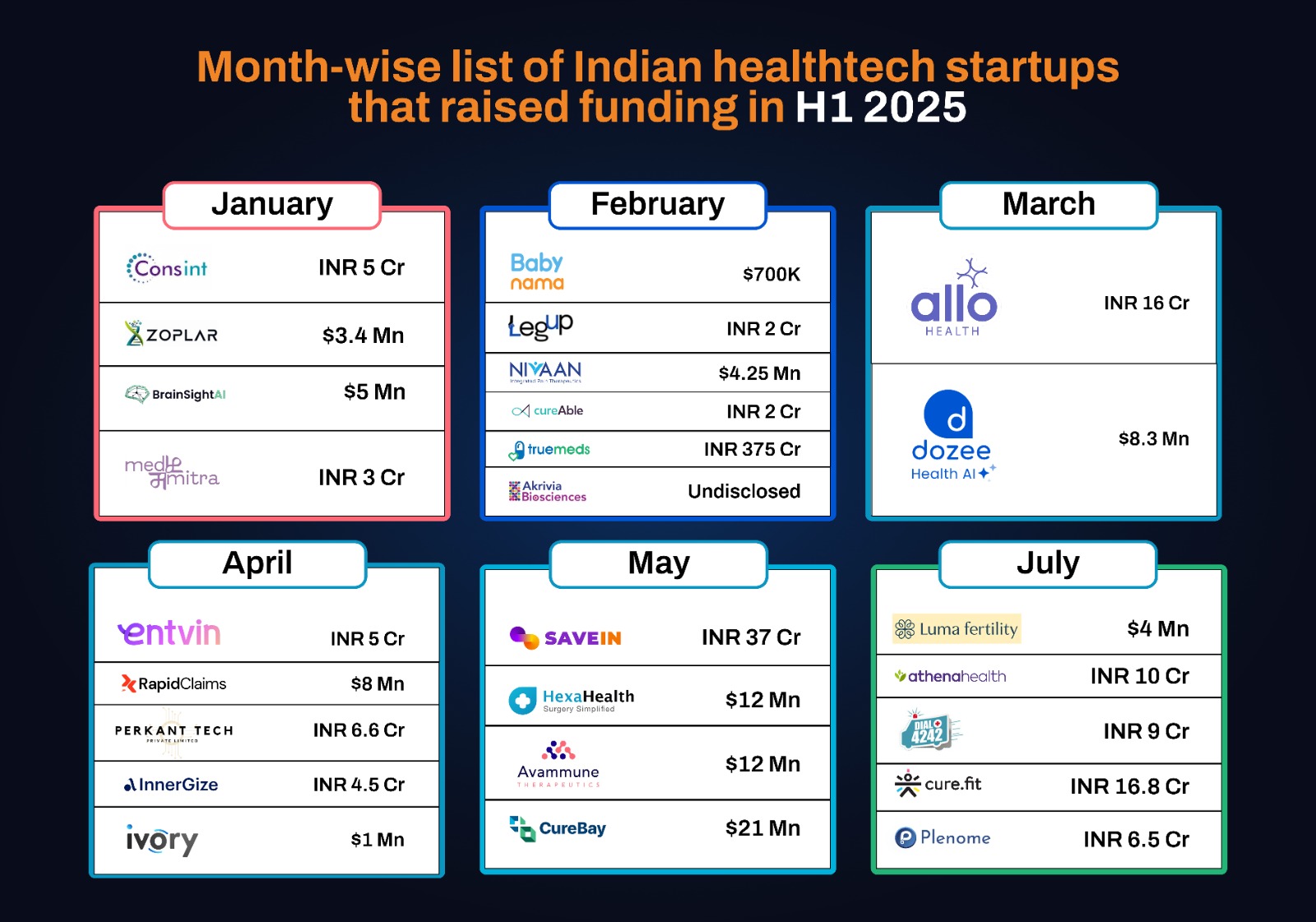

2025 began with a clear signal: deeptech is becoming healthcare’s new muscle. In January alone, four healthtech startups raised capital; each tackling a different system-level gap.

Consint.AI opened the year with an INR 5 Cr seed round led by Equanimity Ventures and Seafund, backing its GenAI platform to detect insurance fraud and streamline claims. At a time when payer-provider alignment remains a bottleneck in Indian healthcare, Consint’s AI-first solution aims to redefine trust and efficiency.

BrainSightAI, the Bengaluru-based neuroscience platform, made waves with a $5 million pre-Series A round to fuel its FDA-ready neuroinformatics product, VoxelBox. This wasn’t just about capital; it was about ambition. With plans to expand across India and into US markets, BrainSight signaled that India’s brain health revolution is just beginning.

Zoplar raised $3.4 million to reinvent medical equipment procurement for Tier II/III hospitals. At the same time, MedMitra AI secured INR 3 Cr to scale its clinical AI stack and launch a dedicated platform for medical students. Taken together, January’s deals weren’t large; but they were foundational, carving out infrastructure across diagnostics, supply chains, insurance, and talent.

February: Care Models Reimagined

February saw a shift from backend tech to care-centric innovation. From pediatrics to chronic pain, this month’s rounds spotlighted startups tackling the granularity of care with verticalized precision.

Babynama, co-founded by pediatrician Dr. Sumitra Meena, raised $700K to scale its chat-first pediatric platform that has already handled 1.5 million parent queries. LegUp, a caregiving platform focused on baby and elder care, secured INR 2 Cr to build job-matching apps for caregivers and grow its verified workforce.

Nivaan Care, a startup rethinking chronic pain, raised $4.25 million to open new clinics and introduce regenerative treatments like autologous cell therapies; a critical play in a country where chronic pain impacts over 270 million people.

Meanwhile, CureAble, which focuses on neurodiverse therapy, closed INR 2 Cr in pre-seed funding from Brahma Tank. Its ambition? To impact over 100 million special-needs children globally using home care, school-based programs, and app-driven therapies.

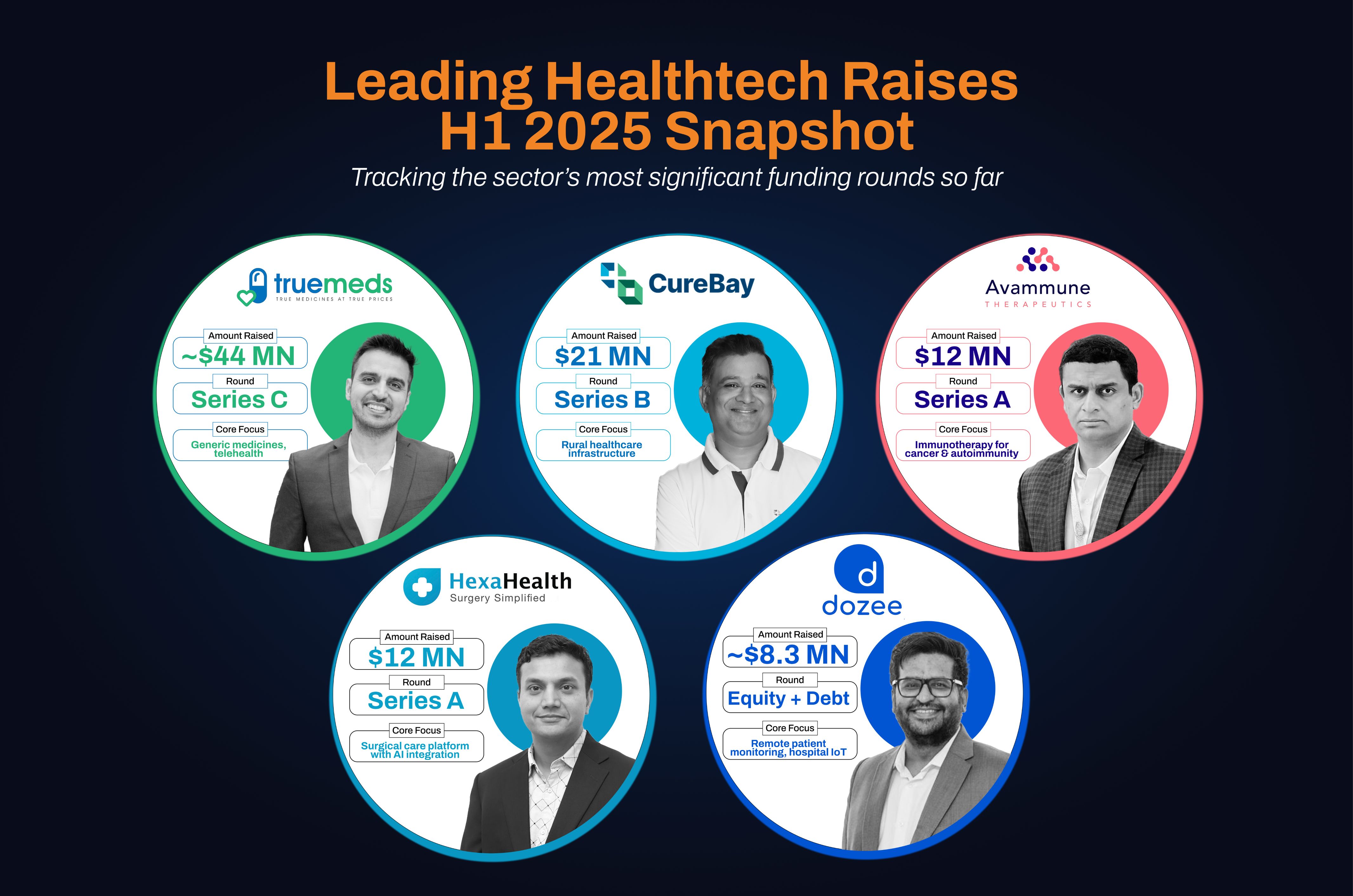

But February’s heavyweight was Truemeds, which raised a massive INR 375 Cr in Series C funding. With backing from Accel India and Info Edge, the generic medicines startup is eyeing deeper market expansion; validating that affordability, when matched with scale and tech, is still a winning formula.

March: From Clinics to Critical Care

March brought a balance of scale and ambition. Allo Health, India’s first sexual health clinic chain, raised INR 16 Cr to expand its discreet, judgment-free care model. With AI-driven protocols and backing from Rainmatter and Nexus VP, Allo is among a handful of startups making sexual health mainstream and measurable.

In the same month, Dozee raised over $8 million in a mixed equity-debt round to enhance its contactless patient monitoring systems and global footprint. With participation from Singapore’s C3H and Stockhausen International, Dozee is a clear example of Indian medtech products gaining credibility abroad.

April: AI is No Longer a Buzzword; It’s Infrastructure

April turned out to be a showcase for AI’s foundational role in healthtech. RapidClaims, a SaaS startup automating insurance claims processing, raised $8 million in Series A funding led by Accel and Together Fund. Its mission: reduce human error and friction in one of the sector’s most complex workflows.

Entvin AI, which builds regulatory AI agents for pharma, secured INR 5 Cr from Y Combinator, highlighting investor appetite for process intelligence in life sciences.

Other notable raises included:

Perkant Tech (INR 6.6 Cr) for AI-based prognostics,

Ivory ($1M) for cognitive screening tech,

InnerGize (INR 4.5 Cr), a D2C mental wellness brand backed by heavyweights like Aman Gupta and OYO’s Ritesh Agarwal.

By April, one thing was clear: AI was no longer being layered onto solutions. It was the solution.

May: From Wellness to Science-Backed Scalability

In May, health tech diversified into four parallel lanes: fintech, surgical infra, immunotherapy, and rural healthcare.

SaveIN, a healthcare-fintech startup offering B2B credit under Welup, raised INR 37 Cr from 10x Founders and Oliver Jung. CEO Jitin Bhasin called the raise “opportunistic,” underlining how embedded finance in health is becoming a moat.

HexaHealth, a surgical platform, closed $12 million to scale surgeries across India using AI and concierge patient services. Having already facilitated 15,000 surgeries in FY25, its model shows that platformization in elective surgeries is viable and thriving.

Avammune Therapeutics, with $12 million in Series A, aims to scale small-molecule immunotherapies for cancer and autoimmune diseases. With backing from Shastra VC, Capital2B, and Kotak’s Life Sciences fund, this was among the most science-heavy raises of the year.

CureBay, a rural-first platform, raised a stunning $21 million to deepen its reach in Bihar, Jharkhand, and UP; proving that healthcare delivery outside metros isn’t just aspirational; it’s bankable.

July: A New Momentum Builds

Though not strictly part of H1, July brought significant deal flow worth documenting. Luma Fertility raised $4 million from Peak XV’s Surge Fund to expand its clinic network beyond Mumbai. Its founder, Neha Motwani, is blending tech and on-ground fertility infrastructure - a rare hybrid model.

Athena Behavioural Health raised INR 10 Cr to expand its psychiatric and addiction services into Northeast and South India. Dial4242, an ambulance tech platform, raised INR 9 Cr to cut down its average response time to under eight minutes; addressing a long-standing emergency care gap.

Also noteworthy was Plenome, which secured INR 6.5 Cr to expand its blockchain-enabled health data platform. Co-founded at IIT Madras, its approach to data security and interoperability points to the future of trust in Indian healthcare.

Month-wise Healthtech Starup Funding H1 2025

The funding boom in H1 2025 wasn’t just about the number of deals but about the kind of capital entering the sector.

Legacy VCs like Accel, Nexus, and 3one4 doubled down on proven plays like Truemeds and HexaHealth. But what truly reshaped the landscape was the influx of deep-specialist and thesis-driven investors.

Brahma Tank’s bet on neurodiverse care (CureAble), Antler’s entry into mental wellness (InnerGize), and IIM-A Ventures’ participation in cognitive health (Ivory) marked a shift from capital chasing TAM to capital enabling care transformation.

Government schemes like BIRAC, NGIS, and Startup India Seed Fund quietly funded six early-stage AI diagnostics, MedTech, and predictive health innovations, building a pipeline that private capital can later scale.

Finally, cross-border credibility is rising. With US-based angels, Stanford alums, and pharma veterans backing April–May deals, Indian health tech is becoming part of the global clinical innovation stack.

From Experiments to Infrastructure: The Healthtech Metamorphosis

The arc of Indian health-tech over the last five years has been as layered as instructive. From the scrappy, reactive innovations that emerged during the pandemic (2020–2022) to the platformization and B2C blitz of 2023–2024, the sector has undergone multiple waves of reinvention. But H1 2025 marks a critical inflection point that signals a decisive turn towards infrastructure, depth, and clinical credibility.

Today, India's health tech startups are no longer content with stitching together fragmented services or chasing scale for scale’s sake. Instead, they build bottom-up systems that are deeply verticalized, operationally robust, and clinically validated. Take Babynama, which is redefining pediatric care with an AI-powered, always-on chat platform. Or CureBay, which invests not in apps but in rural care nodes embedded in tier-III and IV India. Or Avammune Therapeutics, which isn’t optimizing existing therapies but pioneering immunology R&D at the molecular level.

This shift from breadth to precision is not cosmetic; it reflects a strategic reorientation. Startups are picking their trenches and going all-in. Whether it’s fertility, neurodiversity, behavioral health, surgical logistics, or elder care, they’re mastering the last mile and the last detail. Focus is finally beating frenzy.

Meanwhile, AI has moved from augmentation to orchestration. It is no longer a layer on top; it’s the backbone of clinical workflows, whether in early detection (Ivory), insurance adjudication (RapidClaims), or cognitive triage (BrainSightAI). The rise of autonomous and embedded AI across subsectors enhances scalability and pushes startups closer to regulatory-grade innovation; be it FDA alignment or globally deployable protocols.

And just as crucial is the expansion of the healthcare imagination itself. Indian healthtech is shedding its urban, tertiary-care bias. Models built for metros are being replaced; or at least challenged; by care architectures rooted in decentralization, inclusivity, and contextual intelligence. Whether it's Dial4242 building faster ambulance networks, or Athena Behavioral Health targeting underserved geographies like the Northeast, the rebalancing of attention is visible and overdue.

What we are witnessing is not just a sector evolving; it is an entire paradigm being rewritten, from reactive healthcare to proactive health infrastructure.

Top Fundraisers, H1 2025

Conclusion: A Sector Growing Up, With Precision and Purpose

To call Indian health tech a “hot sector” in 2025 would be reductive. It is no longer merely growing; it is maturing with intention, precision, and a hard-won understanding of what healthcare in India demands.

The $828 million raised in H1 2025 is not just capital; it’s commitment. It is a signal from both founders and investors that this sector is no longer running MVP experiments or chasing vanity metrics. Instead, it’s investing in surgical depth, patient journeys, AI orchestration, and hard science. Startups are raising money not just to scale but to specialize.

There’s also a noticeable consolidation of confidence among investors. The repeated participation of marquee names like Accel, WestBridge, and Nexus signals validation. But more importantly, the entry of thematic investors - those backing neurodiverse care, oncology diagnostics, or decentralized insurance - indicates that capital is now following conviction, not just category heat.

Founders, too, are becoming more resolute. They’re willing to delay monetization to build moats, pursue FDA pathways over faster local wins, and go deep in Tier-II/Tier-III India rather than hyper-scale prematurely. This maturity in vision is enabling a more structurally sound sector.

Moreover, the sector’s pipeline is richer than ever fed by deeptech founders, medics-turned-entrepreneurs, IIT/NIT researchers, and even bootstrapped operators with real-world care experience. With government grants, Y Combinator exposure, and new R&D-focused funds entering the fray, India’s healthtech stack is now intellectually and financially diversified.

In a landscape once cluttered with half-built apps and patchy UX, we now see end-to-end care engines, precision-integrating diagnostics, treatment, rehab, and feedback loops. Whether in oncology, pediatrics, sexual health, or digital therapeutics, Indian startups are designing systems that can endure regulatory scrutiny, patient adoption, and cross-border deployment.

As H2 2025 begins, the question is no longer whether Indian health tech can scale. It already can. The real question is how many of these startups will lead the world’s next wave of healthcare innovation?

Because healthtech is no longer just a sector, it is India’s most consequential arena for systemic transformation, and it’s just getting started.

Disclaimer: This article includes insights from India’s healthtech, biotech, and pharma sectors. All data reflects publicly available information as of July 2025 and is subject to updates. The content is editorial in nature and does not constitute medical, financial, or investment advice.