Why are Global Giants Rushing into India’s Healthcare Market? & What Does it Mean for Patients?

Healthcare in India has always been more than just a service. It is one of the largest markets in the world, driven by the needs of over a billion people. For decades, everyone knew the potential. But in recent years, the game has shifted; billions of rupees are now flowing in from private equity giants and foreign investors who see Indian hospitals as the next big prize.

Now, as a patient, does it even matter? And as an Indian, what does it mean when global money starts holding the reins of our hospitals? Let’s find out, beginning with why the market is simply too big to ignore.

A Market Too Big to Ignore

India’s private healthcare is in the middle of a capital super-cycle. Global money, private equity giants, sovereign funds, and pension pools are pouring into hospitals, specialty chains, and allied services at a pace rarely seen elsewhere. The timing raises a sharp question: why now?

In just the last few years, foreign investment has hit record highs. To outside eyes, the opportunity is irresistible. With a population of 1.4 billion and a rapidly ageing demographic, the demand for hospitals, diagnostics, pharmaceuticals, and medtech has never been greater. Rising incomes, urbanisation, insurance penetration, and digital health adoption are pushing the sector toward a projected $650 billion market by 2025.

For investors, India offers what mature markets can no longer promise: scale plus scarcity. Formal FDI into hospitals & diagnostic centres has jumped, while inflows into medical devices and surgical appliances have also risen compared to the prior year, clear signals that capital is betting on both core facilities and enabling infrastructure.

And there’s another structural factor: private providers dominate Indian healthcare. Roughly 63% of India’s 70,000 hospitals are privately owned, and they already deliver the bulk of outpatient and inpatient care across both rural and urban India. Expansion, therefore, is overwhelmingly a private-sector story.

So why is there such a sudden intensity of global money? The return profile makes it clear:

- Room for consolidation: Many regional chains are still sub-scale; bolt-on acquisitions create multi-city platforms with stronger bargaining power.

- Supply–demand mismatch: Bed density and advanced care facilities lag behind urbanizing demand, meaning new capacity is almost guaranteed to be used.

- Exit visibility: With India’s PE/VC market rebounding in 2024, hospital platforms once again have clear IPO or sponsor-to-sponsor exit routes.

- Defensive growth: Unlike consumer goods, healthcare is less cyclical, an attractive hedge in a volatile macro.

The story, then, is simple: India is too big, too under-served, and too profitable to ignore. But this investment rush also sets the stage for the next question: what does all this capital mean for patients facing rising medical bills? If hospitals become investment assets, will patients pay the price?

The Patient Question: Growth vs Affordability

Hospitals in India are no longer just treatment hubs, they are scaling into big brands. Private equity and foreign investors have already pumped in over ₹41,000 crore since 2022, with deal sizes ranging from ₹500–2,000 crore. On paper, it’s growth. But the question is: growth for whom?

India’s healthcare demand is undeniable. More people, more chronic conditions, and the need for better ICUs, diagnostics, and specialist care make expansion critical. Yet, every ₹1,000 crore that goes into shiny infrastructure raises a tough question: Will patients benefit through lower costs and wider access, or will they end up footing higher bills?

The branding of hospitals adds another layer. Plush lobbies, international tie-ups, patient apps, they look progressive. But do they address the ground realities? Long waiting times, patchy affordability, and the gap in smaller cities still remain unresolved.

The real test of this growth wave will be whether it delivers better healthcare to the patient at the right price, or whether India ends up with world-class hospitals that only a few can afford.

Who’s Holding the Scalpel - Indian Promoters or Foreign Giants?

India’s hospital business is no longer just a family-run affair. Global money now owns large chunks of the country’s biggest healthcare chains. From Singapore’s Temasek in Manipal Hospitals to Blackstone in CARE and KIMS, and KKR in HCG, foreign private equity giants are becoming the new power holders in Indian healthcare.

But here’s the tension: when boardrooms sit in Singapore, Toronto, or New York, whose priorities come first, investor returns or patient outcomes? For investors, hospitals are “platform plays” with EBITDA goals. For patients, they are places of care, often the last resort.

This shift in ownership raises hard questions. Will expansion follow medical need, or follow money? Will tier-2 and tier-3 towns see world-class hospitals, or will funds only back metros with deeper pockets? And when global funds decide to exit in five years, what happens to the systems they built?

As Indian hospitals turn into global assets, the scalpel is no longer just in a surgeon’s hand. It is also in the grip of investors. And that changes the kind of cuts the system makes.

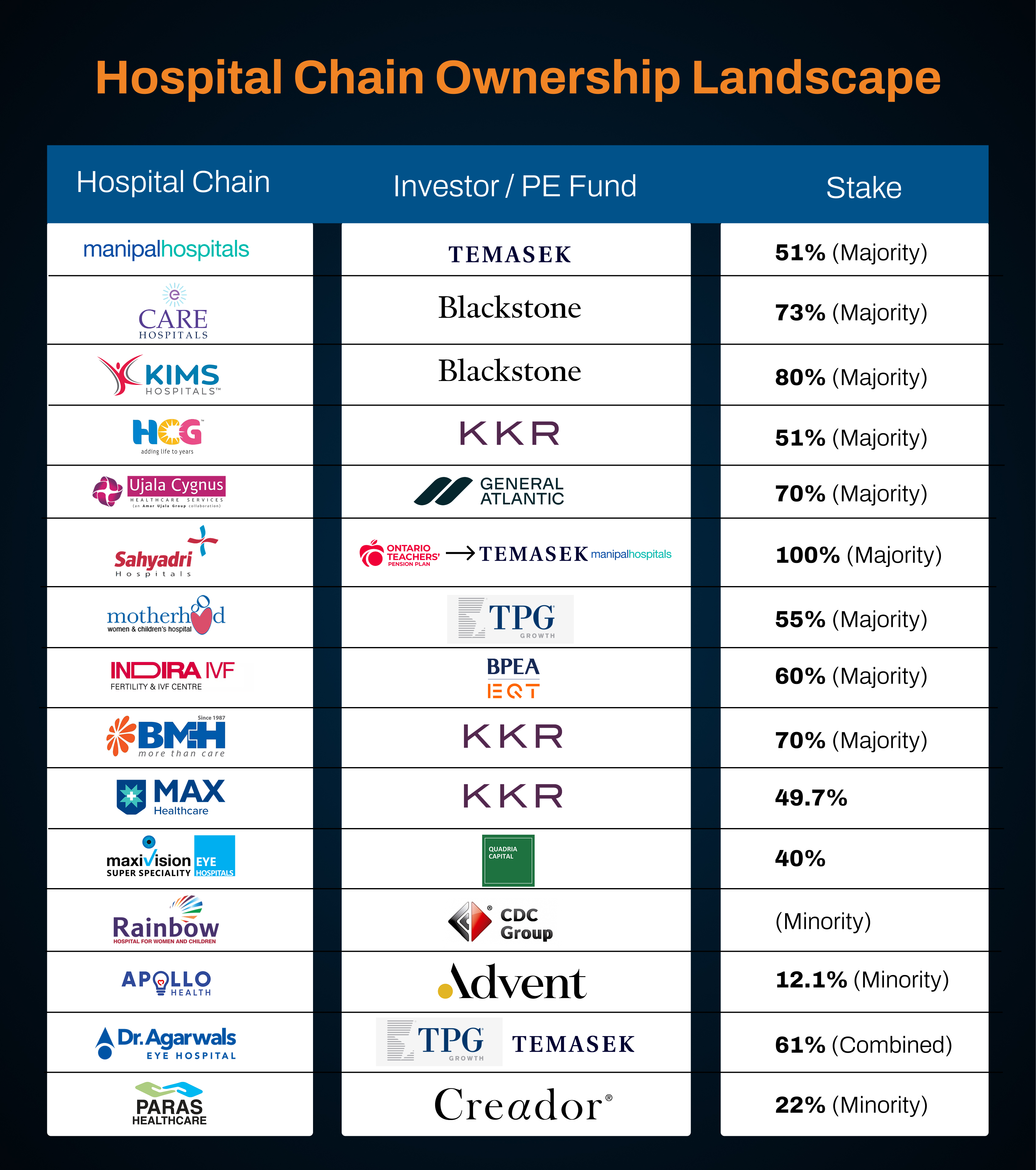

Below is the list of India’s leading hospital chains and the global private equity funds holding significant stakes in them:

Disclaimer: The information above has been compiled from various publicly available online sources. DHN does not endorse or promote any of the companies or investors mentioned.

Foreign & Domestic Funds Deepen Their Hold

Private equity has moved from being an occasional financier to becoming the controlling hand in India’s hospital ecosystem. Temasek, the Singapore sovereign fund, now holds a 51% majority in Manipal Hospitals, cementing its influence over one of the country’s largest healthcare platforms.

Blackstone has gone even further, seizing control of two major southern chains, 73% of CARE Hospitals and 80% of KIMS Hospitals. These moves position foreign funds not as partners, but as majority owners with the power to shape pricing, expansion, and long-term strategy.

KKR has taken a similar path, with a 51% stake in HCG and 70% in Baby Memorial Hospitals, while also holding a near-controlling 49.7% in Max Healthcare. General Atlantic has carved out its presence in Tier-II and Tier-III cities with a 70% stake in Ujala Cygnus. Specialty hospitals are not left behind either. TPG Growth owns 55% of Motherhood Hospitals, and together with Temasek, controls 61% of Dr. Agarwal’s Eye Hospitals. Fertility care, too, has its global backer, with BPEA EQT owning 60% of Indira IVF.

Minority Bets Still in Play

A few funds are playing the long game through minority positions, watching the sector from the sidelines while keeping one foot in the door. Advent International, for example, holds just 12.1% in Apollo HealthCo, giving it exposure without dominance. Quadria Capital has taken a 40% stake in Maxivision Hospitals, while CDC Group has invested at a minority level in Rainbow Hospitals. Creador, too, holds 22% in Paras Healthcare, choosing to influence over outright control.

These smaller bets matter because they act as signals of investor confidence in niche areas such as eye care, maternity care, or regional expansion. While they may not shape board decisions today, they keep the investors close enough to jump in deeper when the opportunity arises. In India’s hospital market, even minority stakes are strategic footholds.

Sovereignty & Dependence

This is where the real debate begins. Should India allow its most critical sector, healthcare, to become increasingly reliant on foreign players? Unlike malls or luxury housing, hospitals are not just another business. They are a public good, tied to national security, economic resilience, and the well-being of every citizen.

Look around the world, and the cautionary tales are plenty. Nations that ceded too much ground in essential services often found themselves struggling to control costs, regulate access, or even steer public health priorities. If foreign giants end up dominating India’s hospital chains, diagnostic labs, or even healthtech platforms, will we still have the power to set fair prices, ensure reach in smaller towns, or decide how healthcare is delivered?

The Other Side of the Coin

And yet, branding all foreign money as a threat would be a mistake. India’s healthcare system needs oxygen in the form of capital. The government cannot possibly build all the hospitals, labs, or digital platforms this country requires at the pace demand is rising. Private equity and global funds bring not just money but also expertise, new technologies, and operational discipline.

Think of advanced AI diagnostics, cutting-edge cancer treatments, or telemedicine solutions scaling across rural India. These don’t emerge in a vacuum; they need the kind of capital and global partnerships foreign investors can offer. In that sense, foreign money is not an invasion but a bridge, one that, if balanced carefully, can take India’s healthcare where it needs to be.

The Bottom Line

Global giants are betting big on India’s healthcare because the demand is undeniable, an expanding middle class, rising chronic disease burden, and gaps in quality infrastructure. Their entry brings capital, scale, and global practices that can modernize hospitals at speed.

For patients, the outcome depends on balance. If investments push hospitals towards world-class standards while keeping services affordable, it’s a win for India. If not, the risk is widening inequality in access to care. The future of Indian healthcare will be defined by how well policymakers and providers channel foreign money towards patient-first priorities.